For most American households, paying full tuition for private school just isn’t feasible. With the average annual cost of tuition equaling $23,839 and the cost of living steadily rising, affording a high-quality private education is harder than ever. According to recent data from LendingClub and PYMNTS, 60% of American adults are living paycheck to paycheck.

That’s where financial aid comes in. As of March 2023, just over 25% of private school students receive some form of aid from their schools, with packages averaging around $21,120 per year. Private school administrators carefully tailor each package to meet every student’s individual needs each year.

But that raises the question—how is financial need determined? And how can schools improve their budgeting strategy to better meet their students’ needs? We’ll discuss everything that goes into the process as well as solutions schools can implement to make excellent education more accessible to everyone.

In This Article

How Do Schools Determine Financial Aid?

Determining the financial needs of students is the most important step in determining their aid package. Although the terms sound similar, need and aid are two separate things:

- Financial need: This is the difference between a school’s educational costs—including tuition and fees—and a household’s ability to pay.

- Financial aid: This is the amount of money a school can provide to reduce the cost of attendance for each student. Most aid packages come in the form of grants, which families don’t need to pay back.

Students may also receive aid from sources outside your financial aid department. Other sources of aid can include:

- External scholarships: Students may receive aid in the form of scholarships from private organizations like the Jack Kent Cooke Foundation or the Children’s Scholarship Fund.

- School scholarships: Your school may offer merit-based scholarships to outstanding students, which can dramatically reduce their needs.

- School vouchers: Certain states provide families with education vouchers that significantly reduce the cost of private school attendance.

So how do schools collect all this information? Parents and caregivers must include many documents in their applications, including several about their finances.

Required Application Documents

For each school year, families generally must submit the following documents to the financial aid department at their child’s school:

- Tax forms: Families should include any tax forms filed for the previous year. They should also include information about tax refunds, as government agencies typically view refunds as a form of income.

- Mortgage or rent information: This information helps determine a household’s real estate assets, whether they own a home or rent additional properties to tenants.

- Bank statements: Applicants should include statements for all accounts, including any checking and savings accounts.

- Investment documentation: Forms documenting all of a household’s financial and material assets are also important in determining their ability to pay tuition.

- Additional expenses: Families should also include records of additional or unusual expenses, such as emergency home repairs or funeral costs.

Your school may also require additional documents depending on the size of your student body, your total financial aid budget, and several other factors.

What Factors Play Into a Household’s Financial Aid Package?

Although many different factors go into calculating a household’s financial needs, some are more important for the process than others. The three biggest factors that affect financial aid awards are total income, expenses, and assets. The school may also consider how many children a single household has enrolled.

Some students may also obtain scholarships from outside organizations. While a scholarship does not impact a student’s eligibility for aid, it will reduce their financial need—which means their financial aid package will likely be smaller. Here’s how these factors all break down.

Income and Expenses

While there are no universal private school financial aid income limits, total household income will be the most significant factor in determining a student’s financial aid package. Income may include a parent’s wages, Social Security benefits, tax refunds and interest earned on savings. Generally speaking, the higher the income, the more families can contribute — however, bigger households will likely need more aid if they plan to enroll multiple children in your school.

To understand the balance between a household’s income and expenses, you should examine both their fixed and variable expenses. Typically, fixed expenses remain steady from month to month, while variable expenses are more likely to fluctuate based on changing needs and external economic factors. Here are some examples of the two:

- Fixed expenses: Fixed expenses include home maintenance, utilities, insurance, tax payments, and savings.

- Variable expenses: Everything else — including gas, groceries, vehicle maintenance, health care, and entertainment — is a variable expense.

These costs will vary depending on your school’s policies surrounding household expenses and the cost of living in your area.

Assets

A household’s assets may include any of the following:

- Cash: This is the amount of liquid cash they have available.

- Savings: Only include non-retirement savings accounts, including health accounts, money market accounts, and high-yield savings accounts.

- Home equity: This is equity in the household’s primary residence if they own their home.

- Real estate: This is equity in investment properties in addition to the primary residence.

- Stocks and bonds: Include stock market investments or collected bonds of any type, including government, corporate, agency, or municipal.

- Securities: Also include any trading assets in addition to stocks and bonds, including ETF shares, certificates of deposit (CDs), or futures

- Vehicles: This is the value of any automotive vehicle that belongs to someone in the household.

- Retirement savings: Retirement savings accounts include a 401(k), an IRA, or a 403(b).

Given the uncertain state of the economy, it’s unrealistic to expect families — especially young ones — to have high assets. Set reasonable expectations for each household’s living expenses and assets to ensure you distribute your financial aid budget fairly among all your students.

Number of Children Enrolled

Generally speaking, most large families have greater financial needs than those with fewer children. Sibling discounts—which private schools would often provide to siblings of current students—used to be common. Now, though, many schools are rethinking this arrangement.

Although sibling discounts are generally shrinking or disappearing altogether, offering this benefit can be an excellent way to make private education more accessible to larger households—and can also help you bring in more students.

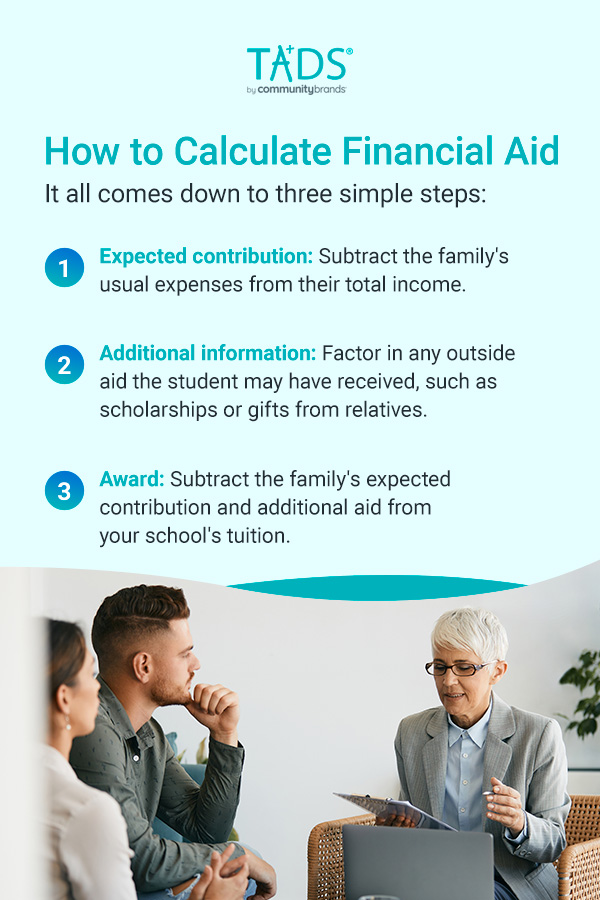

How to Calculate Financial Aid

A lot of information goes into determining how much aid to offer each student. Although the calculations may seem complicated, it all comes down to three simple steps:

- Expected contribution: Subtract the family’s usual expenses from their total income.

- Additional information: Factor in any outside aid the student may have received, such as scholarships or gifts from relatives.

- Award: Subtract the expected contribution and additional aid from your school’s tuition. You should arrive at a reasonable financial aid award.

Important Considerations for Financial Aid Budgeting

Every school’s budget is different, which is why creating a tailored financial aid strategy is so important. Here are some important questions your administrators should ask each year:

- What is your net tuition revenue after granting financial aid?

- Is that revenue enough to meet your operating expenses?

- How does this year’s net revenue compare to that of previous years?

- Will you need to increase your financial aid budget to meet the needs of a growing student body?

- How will providing long-term aid to students throughout their time at your school affect your school’s finances overall?

Once your school has determined the answers to these questions, you can begin revising your budget for the next year. Consider where you can reallocate funding if you need to increase your financial aid budget.

How Can Schools Account for Special Circumstances?

Sometimes, unforeseen circumstances can suddenly make private school tuition more difficult to afford. Some examples include:

- Divorce

- Death of a parent

- Sudden homelessness

- Acute illness

- Unemployment of parents or caregivers

- Other life-altering emergencies

Often, these situations can make it harder for families to afford tuition, even with financial aid. In extreme cases, students may no longer be able to attend your school unless they receive increased aid.

In these situations, school administrators must exercise discretion to evaluate whether to adjust the student’s financial aid award and by how much. It’s important to ensure your financial aid department understands the impact bias can have on financial aid decisions to ensure everyone gets an equal chance at affording a private education.

It’s also possible that a student’s need may accidentally change in your system due to misclassification errors. A parent may transfer funds to their regular IRA and convert it to a Roth IRA, which may affect the financial data you receive even though the family technically doesn’t have any additional income or assets available. Administrators can override these automatic changes to ensure students receive the aid they need.

Common Financial Aid Concerns

Applying for financial aid can be intimidating when the award process is unclear. Here are two of the most common fears parents and guardians have about applying for financial aid at K-12 private schools.

It’s Just Like Financial Aid in Higher Education

With people aged 35 to 49 owing an average of $44,441.67 in student loans, it makes sense that many families would be hesitant about applying for financial aid at their child’s private school. However, private school financial aid for grades K-12 is not like financial aid at higher education institutions, where most students must take out a loan to pay for their education.

Although federal student aid is unavailable for K-12 private schools, that doesn’t mean students won’t get the assistance they need. Financial aid experts at private schools work closely with parents and caregivers to tailor aid packages to their individual needs—and because this aid comes in the form of a grant, they’ll never need to pay it back.

The Process Is Too Complicated

Another factor that tends to deter most families from applying for private school financial aid is the fear of complexity. Many applicants recall the stress of navigating aid in college and understandably worry that the process will be the same for their children. First, there’s the Free Application for Federal Student Aid (FAFSA). Then, there’s the school’s specific financial aid application. And both are time-consuming, frustrating forms.

Unlike at most colleges and universities, applying for financial aid at K-12 private schools is straightforward. Families simply submit their financial information and allow the school’s aid department to figure out the rest. Adopting a financial aid software application that offers a self-service portal for parents and caregivers further simplifies the process by making it quick and easy to submit details and documents as well as monitor their application status.

How Do Schools Manage Financial Aid?

Typically, financial aid is the second-highest item on the budget list for private schools. Effectively managing your financial aid budget is essential for ensuring that each student receives the aid they need to afford tuition at your school.

Financial aid and tuition management software can simplify managing your school’s financial aid budget so you can better serve your student body.

Financial Aid Assessment and Management Software From TADS

At TADS, we strive to help private schools nationwide provide accessible, quality education to students of diverse backgrounds. That’s why we developed our Financial Aid platform, which is fully integrated into our software suite.

Financial aid management software can help schools build trust with families by eliminating the possibility of bias in financial aid calculations. For example, TADS calculates financial aid awards using a unique formula developed by experts in the field.

Parents and legal guardians also have more control over the financial aid process with our software. TADS offers a Parents’ Financial Statement feature that enables caregivers to explain their unique situations and include any additional financial information they feel is important. Schools can use this information to evaluate students on a case-by-case basis.

Manage Financial Aid Awards With TADS Software

If you’re looking for a more efficient way to manage financial aid for private schools K-12, adopting the TADS cloud-based software suite can help you.

Our fully integrated financial aid and tuition management software provides powerful data and analytics capabilities so your financial aid team can make data-driven decisions about your school’s aid budget. And the platform’s secure family portal makes document submission quick and easy, reducing the stress of meeting application deadlines.

Contact us today to schedule a free demo of our financial aid assessment software. We look forward to speaking with you.